Table of Contents

- 💹🔺Inflation's Grip: Challenges and Strategies for Economic Stability 💸📈 ...

- Top Ways to Beat Inflation in India: Guide to Investment

- Investment Tools to beat Inflation in India | Unilinkindia

- India's inflation fight will hurt growth, risks wider fiscal gap | Reuters

- Understanding Inflation In India: Causes, Impact, And Solutions - PWOnlyIAS

- 83% Of Americans Are Belt Tightening Due To Inflation Pressures

- India's inflation at risk from extreme weather, geopolitical issues ...

- India’s sticky Inflation | IASbaba

- NEW INDIA'S INFLATION METRIC - by Anil Padmanabhan

- High Inflation in India - Civilsdaily

India's middle class, which has been the driving force behind the country's economic growth, is feeling the heat as inflation reaches a 14-month high. The rising prices of essential commodities, food, and fuel have led to a significant increase in the cost of living, forcing the middle class to tighten its belt. In this article, we will delve into the impact of inflation on India's middle class and explore the reasons behind this surge in prices.

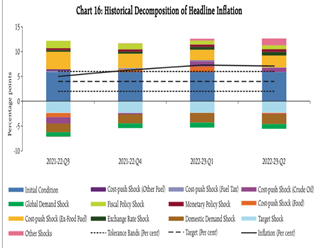

The Current State of Inflation in India

The latest data from the Ministry of Statistics and Programme Implementation reveals that India's retail inflation has reached a 14-month high of 6.07% in February 2023. This is significantly higher than the Reserve Bank of India's (RBI) target of 4% +/- 2%. The main contributors to this increase in inflation are food prices, which have risen by 5.95% year-on-year, and fuel prices, which have increased by 8.03% year-on-year.

Impact on Middle Class

The middle class in India, which accounts for approximately 30% of the population, is feeling the pinch of inflation. With rising prices of essential commodities, the purchasing power of the middle class has decreased significantly. According to a recent survey, 60% of middle-class households have reported a reduction in their savings, while 45% have reported a decrease in their discretionary spending. This has resulted in a decline in demand for non-essential goods and services, which is likely to have a ripple effect on the overall economy.

Reasons Behind the Surge in Inflation

There are several factors that have contributed to the surge in inflation in India. Some of the key reasons include:

- Supply Chain Disruptions: The COVID-19 pandemic and the subsequent lockdowns have led to supply chain disruptions, resulting in a shortage of essential commodities and a rise in prices.

- Rise in Global Commodity Prices: The increase in global commodity prices, particularly crude oil, has led to a rise in fuel prices, which has had a cascading effect on the prices of other goods and services.

- Monsoon Deficit: The deficit in monsoon rainfall has led to a shortage of agricultural produce, resulting in a rise in food prices.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/N7ENS4X5T5IF5LHEZB4N3BKKRU.jpg)

Way Forward

To mitigate the impact of inflation on the middle class, the government and the RBI need to take proactive measures to control prices and increase the purchasing power of the middle class. Some of the measures that can be taken include:

- Monetary Policy: The RBI can use monetary policy tools, such as increasing interest rates, to reduce demand and curb inflation.

- Fiscal Policy: The government can use fiscal policy tools, such as reducing taxes and increasing subsidies, to increase the purchasing power of the middle class.

- Supply Side Reforms: The government can implement supply side reforms, such as improving agricultural productivity and reducing supply chain disruptions, to increase the availability of essential commodities and reduce prices.

In conclusion, the surge in inflation in India has significant implications for the middle class, which is feeling the pinch of rising prices. To mitigate the impact of inflation, the government and the RBI need to take proactive measures to control prices and increase the purchasing power of the middle class. By implementing monetary and fiscal policy measures, and implementing supply side reforms, India can reduce inflation and promote economic growth.