Table of Contents

- Stimulus Payment News - Latest Stimulus Check updates and news

- There's a new secret stimulus check coming, and you have to ask for it

- IRS Sends Surprise Stimulus Checks: How to Check Eligibility

- Tax tips: Claiming stimulus check on IRS 2021 return | ABC7 Chicago ...

- New IRS Site Could Make it Easy for Thieves to Intercept Some Stimulus ...

- IRS Sending Millions $$ Additional Stimulus checks! GOING IN BANKS ...

- Are We Getting Stimulus Checks In 2025 In Usa - Todd M. Anderson

- Stimulus Payment News - Latest Stimulus Check updates and news

- Stimulus Payment News - Latest Stimulus Check updates and news

- Stimulus checks: When you’ll get your money and why some will have to ...

Who is Eligible for a Stimulus Check?

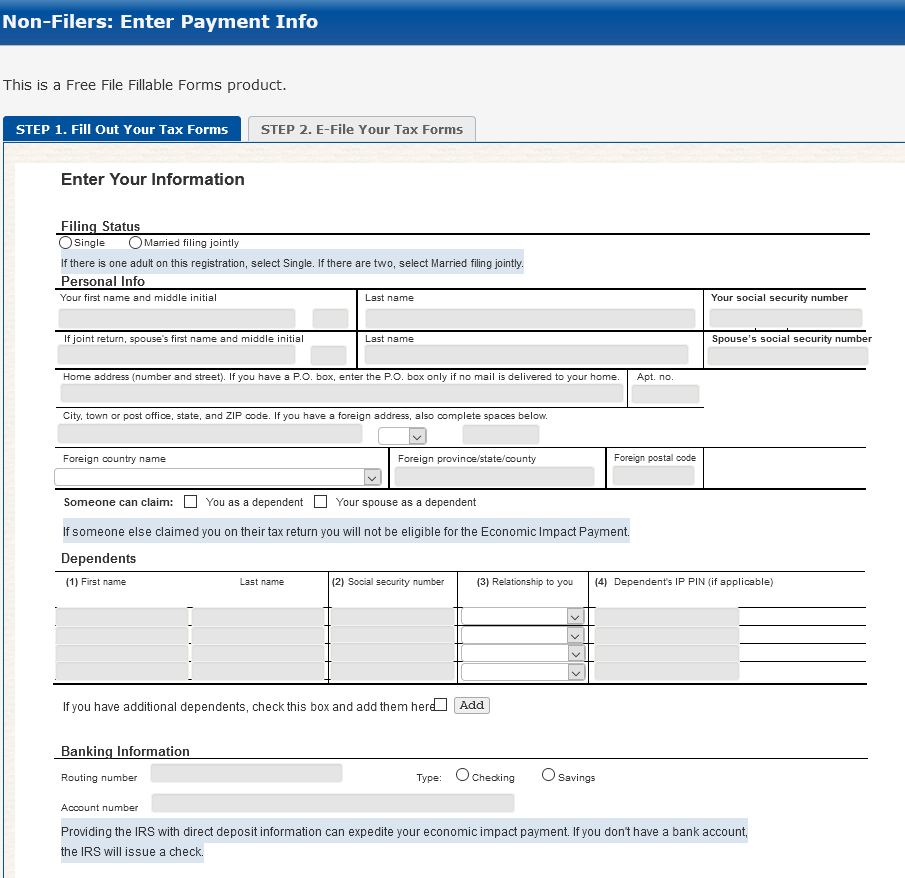

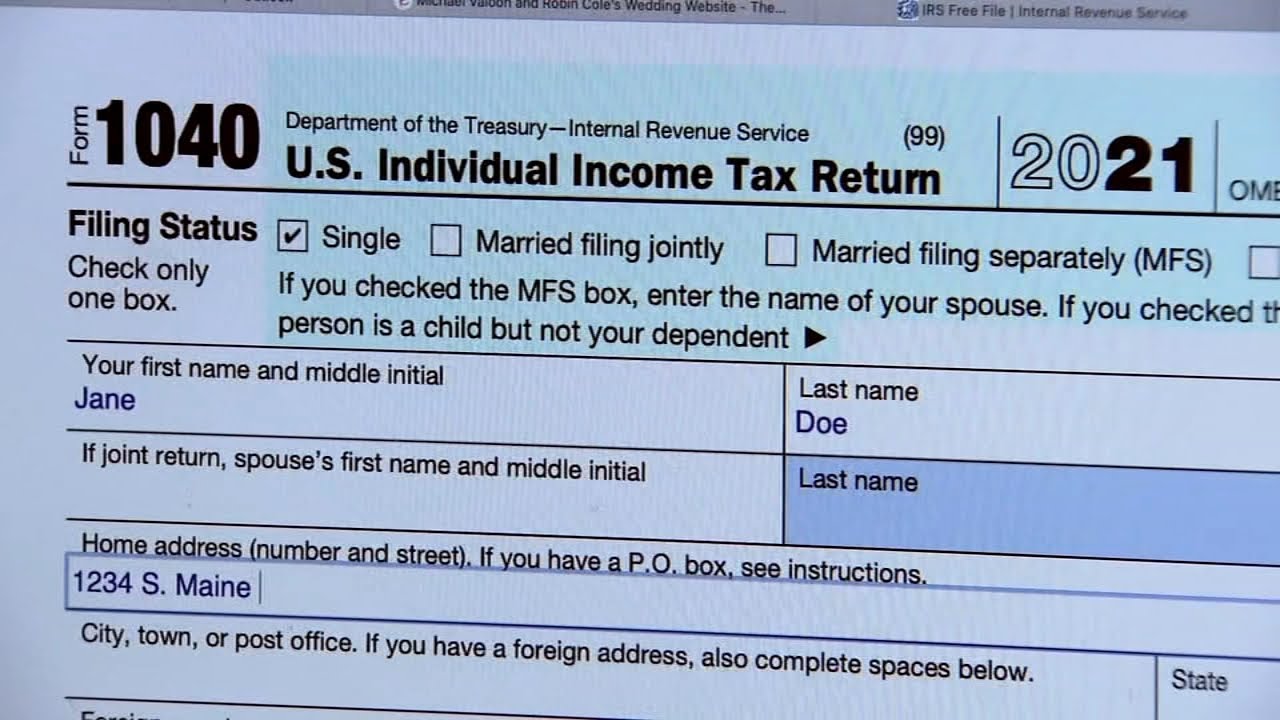

How to Claim Your Stimulus Check

Time is Running Out - Don't Miss Your Chance

The IRS has announced that the deadline for claiming a stimulus check is rapidly approaching. If you have not already claimed your payment, it's essential to act quickly to avoid missing out. The IRS is urging eligible individuals to claim their stimulus check as soon as possible to ensure they receive their payment before the deadline.

What to Do if You're Missing a Stimulus Check

If you believe you are eligible for a stimulus check but have not received your payment, there are steps you can take. First, check the IRS website to see if your payment has been processed. If it has, but you have not received it, you can contact the IRS to report a missing payment. You can also use the IRS's "Get My Payment" tool to track the status of your payment. In conclusion, the IRS stimulus check program is a vital lifeline for many Americans affected by the COVID-19 pandemic. With time running out to claim your payment, it's essential to act quickly to avoid missing out. If you're eligible for a stimulus check, don't hesitate to claim your payment today. Visit the IRS website to check your eligibility and claim your payment before the deadline.Deadline: The deadline for claiming a stimulus check is approaching. Don't miss your chance to receive your payment.

Eligibility: Check the IRS website to see if you're eligible for a stimulus check.

Claim Your Payment: Visit the IRS website to claim your stimulus check today.

Note: The information in this article is subject to change, and it's always best to check the official IRS website for the most up-to-date information on stimulus checks.