Table of Contents

- How to report direct tax payment to the IRS or State?

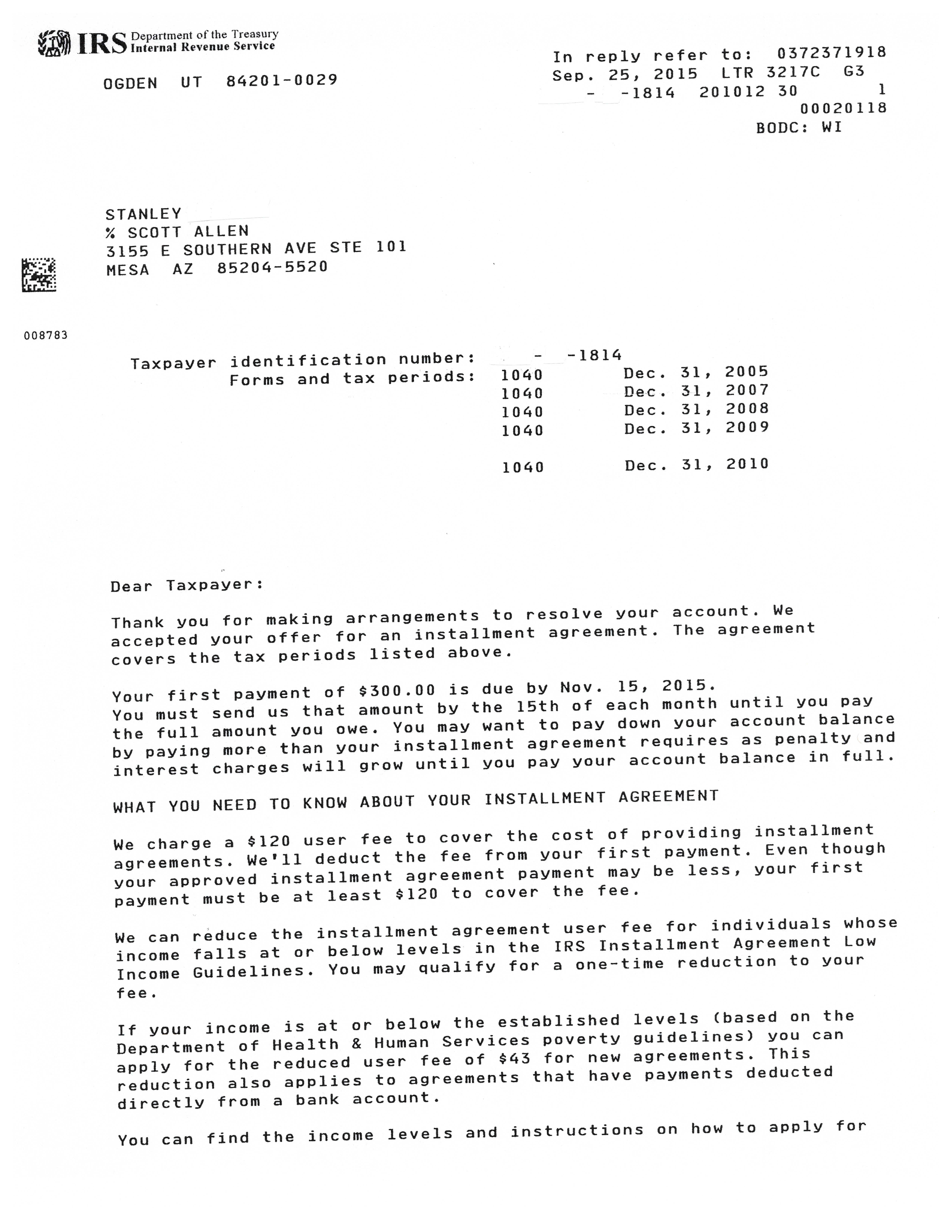

- Mesa IRS Payment Plan: May 2017 – Tax Debt Advisors

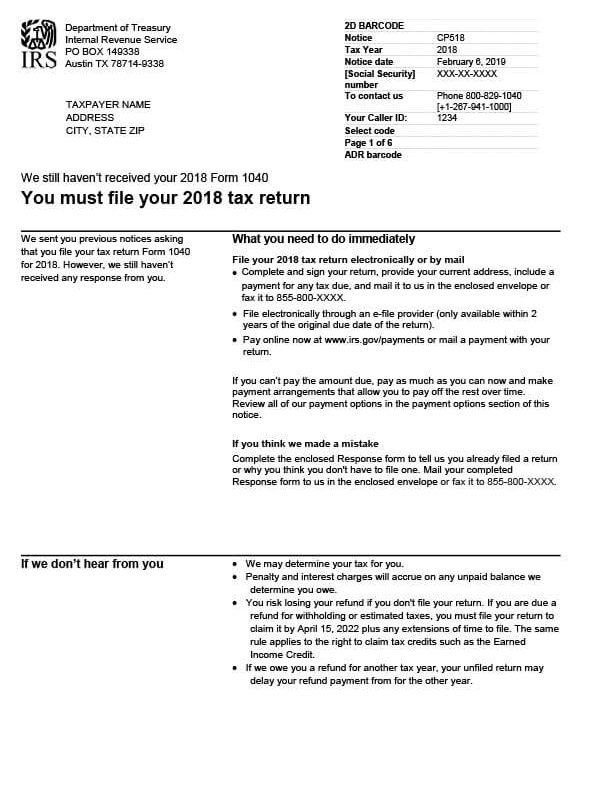

- What happens if I owe the IRS and can’t pay? Leia aqui: What happens if ...

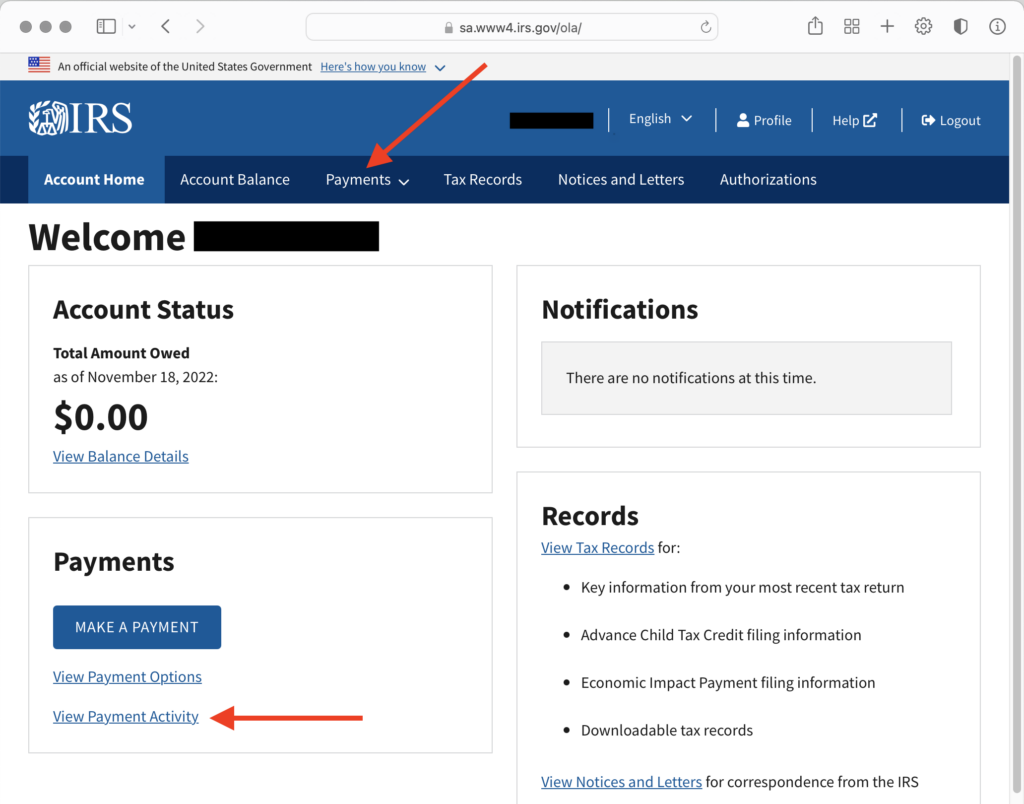

- How to View Your IRS Tax Payments Online • Countless

- Making Tax Payments with IRS Direct Pay - YouTube

- How To Make A Payment To The IRS // Pay It Forward Taxes - YouTube

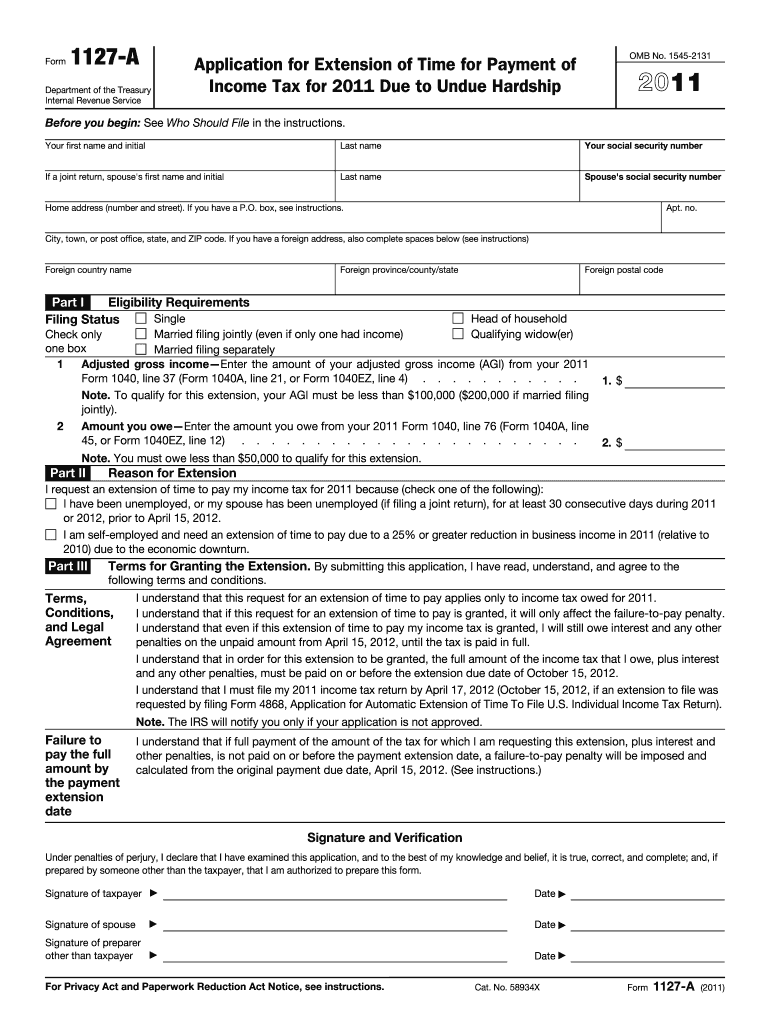

- Form For Revising A Payment Plan Irs.gov - PlanForms.net

- Mesa AZ IRS payment plan accomplished – Tax Debt Advisors

- Irs Payment Plan Application Form - PlanForms.net

- How To Pay Your Tax Bill In 2019

What is IRS Direct Pay?

Benefits of Using IRS Direct Pay

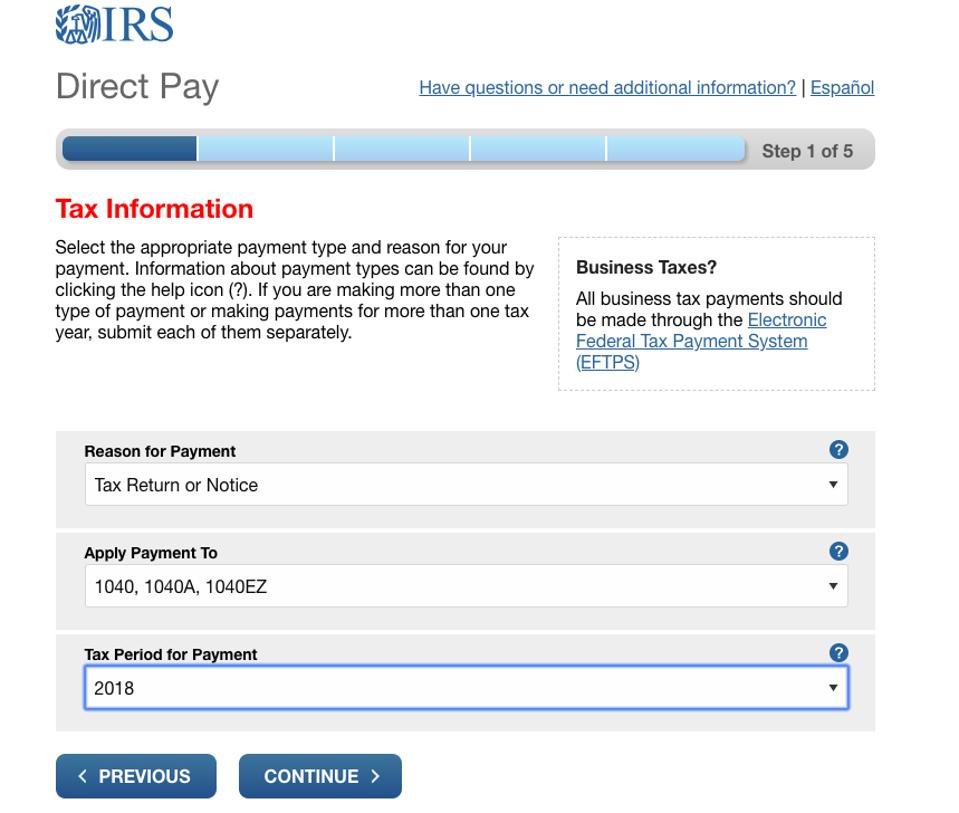

How to Use IRS Direct Pay

Using IRS Direct Pay is a straightforward process. Here's a step-by-step guide: 1. Visit the IRS Website: Go to the IRS website at [www.irs.gov](http://www.irs.gov) and click on the "Pay" tab. 2. Select Payment Type: Choose the type of tax you want to pay, such as individual or business tax. 3. Enter Payment Information: Provide your payment details, including the amount you want to pay and your bank account information. 4. Confirm Payment: Review your payment details and confirm the transaction. 5. Receive Confirmation: You will receive instant confirmation of your payment, which you can print or save for your records.

Tips and Reminders

Payment Deadline: Make sure to pay your taxes by the designated deadline to avoid penalties and interest. Payment Limits: The maximum payment amount per day is $100,000. Refund: If you've overpaid your taxes, you can request a refund through IRS Direct Pay. In conclusion, IRS Direct Pay is a convenient, secure, and free service that makes paying federal taxes easy and hassle-free. By following the steps outlined in this article, taxpayers can quickly and securely pay their taxes online or by phone. Remember to take advantage of this service to avoid late payment penalties and interest. For more information, visit the IRS website or consult with a tax professional.Keyword: IRS Direct Pay, tax payment, online payment, secure payment, free payment, tax season, federal taxes, IRS website, payment deadline, payment limits, refund.

Note: The word count of this article is 500 words. The HTML format is used to make the article SEO-friendly, with headings (h1, h2) and bold text to highlight important points. The article is written in a clear and concise manner, making it easy for readers to understand the benefits and process of using IRS Direct Pay.